Backtesting.py 사용법2

backtesting.py -2

백테스팅 라이브러리인 backtesting.py에 대한 유투브 강의 기록.

총 2~8가지의 챕터로 구성 1번 챕터는 별도로 업로드

2. backtest your dollar cost average strategy

https://www.youtube.com/watch?v=Kgr8JjWX0zk&list=PLnSVMZC68_e48lA4aRYL1yHYZ9nEq9AiH&index=2&ab_channel=ChadThackray

- 매수 조건 : 매주 화요일마다 한달 전보다 5% 가격이 하락한 경우

- 매수량 : ‘10’이란 단위를 정해둠. 종가에 따라 share수를 다르게

import pandas as pd

from backtesting import Backtest, Strategy

from backtesting.test import GOOG

import math

class DCA(Strategy):

amount_to_invest = 10

def init(self):

self.day_of_week = self.I(

lambda x:x,

self.data.Close.s.index.dayofweek,

plot=False

)

def next(self):

if self.day_of_week[-1] == 1 : #every tuesday

self.buy(size=math.floor(self.amount_to_invest / self.data.Close[-1]))

try:

if self.data.Close[-1]/self.data.Close[-30] < 0.95:

self.buy(size=math.floor(self.amount_to_invest / self.data.Close[-1]))

except:

pass

display(GOOG)

GOOG = GOOG * 10**-6

bt = Backtest(

GOOG,

DCA,

trade_on_close=True,)

stats = bt.run()

display(stats)

bt.plot()

trades = stats['_trades']

price_paid = trades['Size'] * trades['EntryPrice']

total_invested = price_paid.sum()

current_shares = trades['Size'].sum()

current_equity = current_shares * GOOG.Close.iloc[-1]

print("Total investment:", total_invested)

print("Current shares:", current_shares)

print("Current equity:", current_equity)

print("Returns:", (current_equity/total_invested)-1)

print('-'*50)

display(trades)

| Open | High | Low | Close | Volume | |

|---|---|---|---|---|---|

| 2004-08-19 | 100.00 | 104.06 | 95.96 | 100.34 | 22351900 |

| 2004-08-20 | 101.01 | 109.08 | 100.50 | 108.31 | 11428600 |

| 2004-08-23 | 110.75 | 113.48 | 109.05 | 109.40 | 9137200 |

| 2004-08-24 | 111.24 | 111.60 | 103.57 | 104.87 | 7631300 |

| 2004-08-25 | 104.96 | 108.00 | 103.88 | 106.00 | 4598900 |

| ... | ... | ... | ... | ... | ... |

| 2013-02-25 | 802.30 | 808.41 | 790.49 | 790.77 | 2303900 |

| 2013-02-26 | 795.00 | 795.95 | 784.40 | 790.13 | 2202500 |

| 2013-02-27 | 794.80 | 804.75 | 791.11 | 799.78 | 2026100 |

| 2013-02-28 | 801.10 | 806.99 | 801.03 | 801.20 | 2265800 |

| 2013-03-01 | 797.80 | 807.14 | 796.15 | 806.19 | 2175400 |

2148 rows × 5 columns

Start 2004-08-19 00:00:00

End 2013-03-01 00:00:00

Duration 3116 days 00:00:00

Exposure Time [%] 99.81378

Equity Final [$] 15291.938059

Equity Peak [$] 15368.252542

Return [%] 52.919381

Buy & Hold Return [%] 703.458242

Return (Ann.) [%] 5.10923

Volatility (Ann.) [%] 12.158924

Sharpe Ratio 0.420204

Sortino Ratio 0.639353

Calmar Ratio 0.187276

Max. Drawdown [%] -27.281891

Avg. Drawdown [%] -1.522278

Max. Drawdown Duration 1094 days 00:00:00

Avg. Drawdown Duration 45 days 00:00:00

# Trades 556

Win Rate [%] 99.820144

Best Trade [%] 688.737941

Worst Trade [%] -0.700254

Avg. Trade [%] 79.947572

Max. Trade Duration 3110 days 00:00:00

Avg. Trade Duration 1543 days 00:00:00

Profit Factor 75574.058032

Expectancy [%] 95.180471

SQN 22.806857

_strategy DCA

_equity_curve ...

_trades Size Entr...

dtype: object

Total investment: 5559.868070299999

Current shares: 13544441

Current equity: 10919.39288979

Returns: 0.9639661861977982

--------------------------------------------------

| Size | EntryBar | ExitBar | EntryPrice | ExitPrice | PnL | ReturnPct | EntryTime | ExitTime | Duration | |

|---|---|---|---|---|---|---|---|---|---|---|

| 0 | 12656 | 2144 | 2146 | 0.000790 | 0.000801 | 0.140102 | 0.014010 | 2013-02-26 | 2013-02-28 | 2 days |

| 1 | 12393 | 2139 | 2146 | 0.000807 | 0.000801 | -0.070020 | -0.007003 | 2013-02-19 | 2013-02-28 | 9 days |

| 2 | 12809 | 2135 | 2146 | 0.000781 | 0.000801 | 0.262584 | 0.026258 | 2013-02-12 | 2013-02-28 | 16 days |

| 3 | 13059 | 2130 | 2146 | 0.000766 | 0.000801 | 0.463072 | 0.046308 | 2013-02-05 | 2013-02-28 | 23 days |

| 4 | 13268 | 2125 | 2146 | 0.000754 | 0.000801 | 0.630495 | 0.063051 | 2013-01-29 | 2013-02-28 | 30 days |

| ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... |

| 551 | 84860 | 22 | 2146 | 0.000118 | 0.000801 | 57.989930 | 5.799050 | 2004-09-21 | 2013-02-28 | 3082 days |

| 552 | 89694 | 17 | 2146 | 0.000111 | 0.000801 | 61.862849 | 6.186295 | 2004-09-14 | 2013-02-28 | 3089 days |

| 553 | 98444 | 12 | 2146 | 0.000102 | 0.000801 | 68.873391 | 6.887379 | 2004-09-07 | 2013-02-28 | 3096 days |

| 554 | 97684 | 8 | 2146 | 0.000102 | 0.000801 | 68.264510 | 6.826512 | 2004-08-31 | 2013-02-28 | 3103 days |

| 555 | 95356 | 3 | 2146 | 0.000105 | 0.000801 | 66.399243 | 6.639935 | 2004-08-24 | 2013-02-28 | 3110 days |

556 rows × 10 columns

3. Custom Indicators In Backtesting.py - Python Deep Dive

https://www.youtube.com/watch?v=xljQpeYQYkI&list=PLnSVMZC68_e48lA4aRYL1yHYZ9nEq9AiH&index=3&ab_channel=ChadThackray

백테스트를 위한 지표(시그널)을 입력하는 3가지 방법을 다룸

-

데이터에 시그널이 포함되어 있는 경우

-

외부 라이브러리(ex : TA)에서 지표를 계산하는 경우

-

파이썬으로 직접 계산하는 경우

1. Bringing Signal

엑셀이나 파이썬으로 직접 데이터에 시그널을 주고서 하는 방식

- 랜덤으로 정한 시그널로 매수/매도

import pandas as pd

from backtesting import Backtest, Strategy

from backtesting.test import GOOG

import math

import numpy as np

# outside signal

GOOG['Signal'] = np.random.randint(-1, 2, len(GOOG))

class SignalStrategy(Strategy):

def init(self):

pass

def next(self):

current_signal = self.data.Signal[-1]

if current_signal == 1:

if not self.position:

self.buy()

elif current_signal == -1:

if self.position:

self.position.close()

bt = Backtest(GOOG, SignalStrategy, cash = 10_000)

stats = bt.run()

display(stats)

bt.plot()

Start 2004-08-19 00:00:00

End 2013-03-01 00:00:00

Duration 3116 days 00:00:00

Exposure Time [%] 69.180633

Equity Final [$] 26655.53

Equity Peak [$] 26655.53

Return [%] 166.5553

Buy & Hold Return [%] 703.458242

Return (Ann.) [%] 12.189627

Volatility (Ann.) [%] 27.921745

Sharpe Ratio 0.436564

Sortino Ratio 0.764974

Calmar Ratio 0.353457

Max. Drawdown [%] -34.486849

Avg. Drawdown [%] -6.197988

Max. Drawdown Duration 1456 days 00:00:00

Avg. Drawdown Duration 126 days 00:00:00

# Trades 370

Win Rate [%] 53.783784

Best Trade [%] 17.6706

Worst Trade [%] -11.045732

Avg. Trade [%] 0.266155

Max. Trade Duration 23 days 00:00:00

Avg. Trade Duration 5 days 00:00:00

Profit Factor 1.312063

Expectancy [%] 0.328889

SQN 1.27153

_strategy SignalStrategy

_equity_curve Eq...

_trades Size Entry...

dtype: object

2. External Library - TA

외부 라이브러리를 활용해서 self.I 함수안에 넣어주는 방법

- 매수조건 : 볼린저 밴드 하단 통과

- 매도조건 : 볼린저 밴드 상단 통과

import pandas as pd

from backtesting import Backtest, Strategy

from backtesting.test import GOOG

import pandas_ta as ta

import numpy as np

def indicator(data):

# Data is going to be our OHLCV

bbands = ta.bbands(close = data.Close.s, std=1)

# print(bbands.to_numpy().T[:3])

return bbands.to_numpy().T[:3]

class BBStrategy(Strategy):

def init(self):

self.bbands = self.I(indicator, self.data) # transpose of indicator return

# print(self.bbands)

def next(self):

lower_band = self.bbands[0]

upper_band = self.bbands[2]

if self.position :

if self.data.Close[-1] > upper_band[-1]:

self.position.close()

else:

if self.data.Close[-1] < lower_band[-1]:

self.buy()

bt = Backtest(GOOG, BBStrategy, cash = 10_000)

stats = bt.run()

display(stats)

bt.plot()

Start 2004-08-19 00:00:00

End 2013-03-01 00:00:00

Duration 3116 days 00:00:00

Exposure Time [%] 51.024209

Equity Final [$] 16717.99

Equity Peak [$] 20787.47

Return [%] 67.1799

Buy & Hold Return [%] 703.458242

Return (Ann.) [%] 6.21445

Volatility (Ann.) [%] 26.934367

Sharpe Ratio 0.230726

Sortino Ratio 0.392521

Calmar Ratio 0.13733

Max. Drawdown [%] -45.252068

Avg. Drawdown [%] -5.177251

Max. Drawdown Duration 1940 days 00:00:00

Avg. Drawdown Duration 111 days 00:00:00

# Trades 148

Win Rate [%] 70.945946

Best Trade [%] 22.160665

Worst Trade [%] -20.342013

Avg. Trade [%] 0.349693

Max. Trade Duration 35 days 00:00:00

Avg. Trade Duration 10 days 00:00:00

Profit Factor 1.330771

Expectancy [%] 0.490567

SQN 0.686477

_strategy BBStrategy

_equity_curve Eq...

_trades Size Entry...

dtype: object

3. pure pandas strategy

파이썬으로 직접 코딩하는 방법

- 매수조건 : 7거래일전보다 이틀 연속 5% 이상 상승하면 매수

- 매도조건 : 7거래일전보다 하락시 매도

import pandas as pd

from backtesting import Backtest, Strategy

from backtesting.test import GOOG

import numpy as np

def indicator(data):

# Data is going to be our OHLCV

return data.Close.s.pct_change(periods=7) * 100

class MomentumStrategy(Strategy):

def init(self):

self.pct_change = self.I(indicator, self.data)

# print(self.pct_change)

def next(self):

change = self.pct_change[-1]

if self.position:

if change < 0: # 7일전보다 하락 시 매도

self.position.close()

else:

if change > 5 and self.pct_change[-2] > 5: # 7일전보다 이틀연속 5% 이상 상승하면 매수

self.buy()

bt = Backtest(GOOG, MomentumStrategy, cash = 10_000)

stats = bt.run()

display(stats)

bt.plot()

Start 2004-08-19 00:00:00

End 2013-03-01 00:00:00

Duration 3116 days 00:00:00

Exposure Time [%] 28.67784

Equity Final [$] 35682.52

Equity Peak [$] 36080.72

Return [%] 256.8252

Buy & Hold Return [%] 703.458242

Return (Ann.) [%] 16.09492

Volatility (Ann.) [%] 20.578084

Sharpe Ratio 0.782139

Sortino Ratio 1.551623

Calmar Ratio 0.648687

Max. Drawdown [%] -24.811528

Avg. Drawdown [%] -4.490047

Max. Drawdown Duration 568 days 00:00:00

Avg. Drawdown Duration 65 days 00:00:00

# Trades 51

Win Rate [%] 43.137255

Best Trade [%] 54.603835

Worst Trade [%] -8.768737

Avg. Trade [%] 2.548744

Max. Trade Duration 54 days 00:00:00

Avg. Trade Duration 16 days 00:00:00

Profit Factor 2.790736

Expectancy [%] 3.050381

SQN 2.071855

_strategy MomentumStrategy

_equity_curve Eq...

_trades Size EntryB...

dtype: object

4. Stop Losses in Backtesting.py

https://www.youtube.com/watch?v=_R-X7yFxweI&list=PLnSVMZC68_e48lA4aRYL1yHYZ9nEq9AiH&index=4&ab_channel=ChadThackray

다음의 주소에서 backtesting.py 코드를 직접 공부하기를 권장함.

스탑로스를 적용하기 위해서는 꽤 중요한 내용임.

https://github.com/kernc/backtesting.py/blob/master/backtesting/backtesting.py

- class _Broker

일반적이지 않게, TrailingStrategy 클래스를 상속받아서 실행 : super().init() 사용 필수

-

self.buy(sl=price-10) : 일봉 기준으로 -10일 경우, 실행

-

super.set_trailing_sl(5) : 이전데이터를 참고하여 5ATR 하락하면 실행

-

broker가 먼저 실행되기 때문에 이 스탑로스는 하나의 bar에서만 실행된다. 반면에 위에 부모 클래스의 스탑로스는 다음바에서도 실행한다.

boker is evaluated before strategyand that's why this effect where this is in effect in one bar because this is sent straight to the broker. whereas on the next bar parents' stop loss get triggered.

from backtesting import Backtest, Strategy

from backtesting.test import GOOG

from backtesting.lib import crossover, TrailingStrategy

import ta

print(GOOG)

class Strat(TrailingStrategy):

def init(self):

super().init() # TratilingStrategy 우선 실행

super().set_trailing_sl(5) # 5 times the averate true range (5 ATR)

pass

def next(self):

super().next() # inherits parent's next function

if self.position:

pass

else:

price = self.data.Close[-1]

self.buy(size = 1, sl= price -10, tp=price+20) # sl, tp : 가격을 기준으로 설정

bt = Backtest(GOOG, Strat, cash = 10_000)

stats = bt.run()

display(stats)

bt.plot()

display(stats['_trades'])

Open High Low Close Volume Signal

2004-08-19 100.00 104.06 95.96 100.34 22351900 1

2004-08-20 101.01 109.08 100.50 108.31 11428600 -1

2004-08-23 110.75 113.48 109.05 109.40 9137200 -1

2004-08-24 111.24 111.60 103.57 104.87 7631300 -1

2004-08-25 104.96 108.00 103.88 106.00 4598900 1

... ... ... ... ... ... ...

2013-02-25 802.30 808.41 790.49 790.77 2303900 1

2013-02-26 795.00 795.95 784.40 790.13 2202500 1

2013-02-27 794.80 804.75 791.11 799.78 2026100 -1

2013-02-28 801.10 806.99 801.03 801.20 2265800 -1

2013-03-01 797.80 807.14 796.15 806.19 2175400 0

[2148 rows x 6 columns]

Start 2004-08-19 00:00:00

End 2013-03-01 00:00:00

Duration 3116 days 00:00:00

Exposure Time [%] 99.90689

Equity Final [$] 10419.19

Equity Peak [$] 10466.11

Return [%] 4.1919

Buy & Hold Return [%] 703.458242

Return (Ann.) [%] 0.482921

Volatility (Ann.) [%] 1.243346

Sharpe Ratio 0.388404

Sortino Ratio 0.586101

Calmar Ratio 0.093847

Max. Drawdown [%] -5.145847

Avg. Drawdown [%] -0.247192

Max. Drawdown Duration 1941 days 00:00:00

Avg. Drawdown Duration 63 days 00:00:00

# Trades 572

Win Rate [%] 36.888112

Best Trade [%] 18.473123

Worst Trade [%] -11.491559

Avg. Trade [%] 0.251245

Max. Trade Duration 40 days 00:00:00

Avg. Trade Duration 4 days 00:00:00

Profit Factor 1.241641

Expectancy [%] 0.321574

SQN 1.119355

_strategy Strat

_equity_curve Eq...

_trades Size Entry...

dtype: object

| Size | EntryBar | ExitBar | EntryPrice | ExitPrice | PnL | ReturnPct | EntryTime | ExitTime | Duration | |

|---|---|---|---|---|---|---|---|---|---|---|

| 0 | 1 | 2 | 28 | 110.75 | 128.31 | 17.56 | 0.158555 | 2004-08-23 | 2004-09-29 | 37 days |

| 1 | 1 | 29 | 42 | 129.90 | 151.08 | 21.18 | 0.163048 | 2004-09-30 | 2004-10-19 | 19 days |

| 2 | 1 | 43 | 45 | 148.03 | 170.54 | 22.51 | 0.152064 | 2004-10-20 | 2004-10-22 | 2 days |

| 3 | 1 | 46 | 46 | 176.40 | 192.43 | 16.03 | 0.090873 | 2004-10-25 | 2004-10-25 | 0 days |

| 4 | 1 | 47 | 55 | 186.34 | 177.40 | -8.94 | -0.047977 | 2004-10-26 | 2004-11-05 | 10 days |

| ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... |

| 567 | 1 | 2130 | 2133 | 761.13 | 780.13 | 19.00 | 0.024963 | 2013-02-05 | 2013-02-08 | 3 days |

| 568 | 1 | 2134 | 2134 | 778.40 | 775.37 | -3.03 | -0.003893 | 2013-02-11 | 2013-02-11 | 0 days |

| 569 | 1 | 2135 | 2139 | 781.75 | 802.42 | 20.67 | 0.026441 | 2013-02-12 | 2013-02-19 | 7 days |

| 570 | 1 | 2140 | 2140 | 805.30 | 796.85 | -8.45 | -0.010493 | 2013-02-20 | 2013-02-20 | 0 days |

| 571 | 1 | 2141 | 2147 | 798.00 | 797.80 | -0.20 | -0.000251 | 2013-02-21 | 2013-03-01 | 8 days |

572 rows × 10 columns

TrailingStrategy https://github.com/kernc/backtesting.py/blob/master/backtesting/lib.py

from backtesting import Backtest, Strategy

from backtesting.test import GOOG

from backtesting.lib import crossover

import ta

print(GOOG)

class TrailingStrategy(Strategy):

__dollar_amount = 20.

def init(self):

super().init()

def set_trailing_sl(self, dollar_amount: float = 6):

self.__doloar_amount = dollar_amount

def next(self):

super().next()

# Can't use index=-1 because self.__atr is not an Indicator type

index = len(self.data)-1

for trade in self.trades:

if trade.is_long:

trade.sl = max(trade.sl or -np.inf,

self.data.Close[index] - self.__dollar_amount)

else:

trade.sl = min(trade.sl or np.inf,

self.data.Close[index] + self.__dollar_amount)

class Strat(TrailingStrategy):

def init(self):

super().init() # TratilingStrategy 우선 실행

super().set_trailing_sl(2) # 5 times the averate true range (5 ATR)

def next(self):

super().next() # inherits parent's next function

if self.position:

pass

else:

price = self.data.Close[-1]

self.buy(size = 1, sl= price -50, tp=price+20) # sl, tp : 가격을 기준으로 설정

# broker가 먼저 실행되기 때문에 이 스탑로스는 하나의 bar에서만 실행된다. 반면에 위에 부모 클래스의 스탑로스는 다음바에서도 실행한다.

# boker is evaluated before strategyand that's why this effect where this is in effect in one bar because this is sent straight to the broker.

# whereas on the next bar parents' stop loss get triggered

bt = Backtest(GOOG, Strat, cash = 10_000)

stats = bt.run()

display(stats)

bt.plot()

display(stats['_trades'])

Open High Low Close Volume Signal

2004-08-19 100.00 104.06 95.96 100.34 22351900 1

2004-08-20 101.01 109.08 100.50 108.31 11428600 -1

2004-08-23 110.75 113.48 109.05 109.40 9137200 -1

2004-08-24 111.24 111.60 103.57 104.87 7631300 -1

2004-08-25 104.96 108.00 103.88 106.00 4598900 1

... ... ... ... ... ... ...

2013-02-25 802.30 808.41 790.49 790.77 2303900 1

2013-02-26 795.00 795.95 784.40 790.13 2202500 1

2013-02-27 794.80 804.75 791.11 799.78 2026100 -1

2013-02-28 801.10 806.99 801.03 801.20 2265800 -1

2013-03-01 797.80 807.14 796.15 806.19 2175400 0

[2148 rows x 6 columns]

Start 2004-08-19 00:00:00

End 2013-03-01 00:00:00

Duration 3116 days 00:00:00

Exposure Time [%] 99.90689

Equity Final [$] 10544.29

Equity Peak [$] 10551.79

Return [%] 5.4429

Buy & Hold Return [%] 703.458242

Return (Ann.) [%] 0.623718

Volatility (Ann.) [%] 1.346005

Sharpe Ratio 0.463384

Sortino Ratio 0.676488

Calmar Ratio 0.151369

Max. Drawdown [%] -4.120507

Avg. Drawdown [%] -0.230395

Max. Drawdown Duration 1905 days 00:00:00

Avg. Drawdown Duration 63 days 00:00:00

# Trades 338

Win Rate [%] 52.95858

Best Trade [%] 17.072797

Worst Trade [%] -13.433367

Avg. Trade [%] 0.506673

Max. Trade Duration 43 days 00:00:00

Avg. Trade Duration 8 days 00:00:00

Profit Factor 1.343141

Expectancy [%] 0.635487

SQN 1.350703

_strategy Strat

_equity_curve Eq...

_trades Size Entry...

dtype: object

| Size | EntryBar | ExitBar | EntryPrice | ExitPrice | PnL | ReturnPct | EntryTime | ExitTime | Duration | |

|---|---|---|---|---|---|---|---|---|---|---|

| 0 | 1 | 2 | 28 | 110.75 | 128.31 | 17.56 | 0.158555 | 2004-08-23 | 2004-09-29 | 37 days |

| 1 | 1 | 29 | 42 | 129.90 | 151.08 | 21.18 | 0.163048 | 2004-09-30 | 2004-10-19 | 19 days |

| 2 | 1 | 43 | 45 | 148.03 | 170.54 | 22.51 | 0.152064 | 2004-10-20 | 2004-10-22 | 2 days |

| 3 | 1 | 46 | 46 | 176.40 | 192.43 | 16.03 | 0.090873 | 2004-10-25 | 2004-10-25 | 0 days |

| 4 | 1 | 47 | 55 | 186.34 | 176.03 | -10.31 | -0.055329 | 2004-10-26 | 2004-11-05 | 10 days |

| ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... |

| 333 | 1 | 2114 | 2116 | 742.00 | 719.33 | -22.67 | -0.030553 | 2013-01-11 | 2013-01-15 | 4 days |

| 334 | 1 | 2117 | 2121 | 722.40 | 744.93 | 22.53 | 0.031188 | 2013-01-16 | 2013-01-23 | 7 days |

| 335 | 1 | 2122 | 2128 | 741.24 | 761.50 | 20.26 | 0.027333 | 2013-01-24 | 2013-02-01 | 8 days |

| 336 | 1 | 2129 | 2139 | 767.69 | 795.99 | 28.30 | 0.036864 | 2013-02-04 | 2013-02-19 | 15 days |

| 337 | 1 | 2140 | 2147 | 805.30 | 797.80 | -7.50 | -0.009313 | 2013-02-20 | 2013-03-01 | 9 days |

338 rows × 10 columns

5. Backtest Validation in Python (Fooled by Randomness)

https://www.youtube.com/watch?v=lXJclKmQR-k&list=PLnSVMZC68_e48lA4aRYL1yHYZ9nEq9AiH&index=5&ab_channel=ChadThackray

여러 시간대를 for문을 돌려서 백테스트 해보는 것 » 아래 코드는 비트코인 분봉으로 예시를 들어서, 유투브 내용 중 중간까지 진행 후 중단.

- rsi 지표 활용

import talib

from backtesting import Backtest, Strategy

from backtesting.lib import crossover

from backtesting.test import GOOG

class RsiOscillator(Strategy):

upper_bound = 75

lower_bound = 25

rsi_window = 23

def init(self):

self.rsi = self.I(talib.RSI, self.data.Close.s, self.rsi_window)

def next(self):

if crossover(self.rsi, self.upper_bound):

self.position.close()

elif crossover(self.lower_bound, self.rsi):

self.buy()

bt = Backtest(GOOG, RsiOscillator, cash=10_000_000, commission=.002)

stats = bt.run(upper_bound=70, lower_bound=30, rsi_window=23)

lower_bound = stats['_strategy'].lower_bound

upper_bound = stats['_strategy'].upper_bound

rsi_window = stats['_strategy'].rsi_window

print(lower_bound,"-", upper_bound,"-", rsi_window)

print(stats)

bt.plot()

30 - 70 - 23

Start 2004-08-19 00:00:00

End 2013-03-01 00:00:00

Duration 3116 days 00:00:00

Exposure Time [%] 16.945996

Equity Final [$] 11525842.05574

Equity Peak [$] 12130678.83574

Return [%] 15.258421

Buy & Hold Return [%] 703.458242

Return (Ann.) [%] 1.679954

Volatility (Ann.) [%] 21.587707

Sharpe Ratio 0.07782

Sortino Ratio 0.125282

Calmar Ratio 0.029616

Max. Drawdown [%] -56.725159

Avg. Drawdown [%] -12.199213

Max. Drawdown Duration 1761 days 00:00:00

Avg. Drawdown Duration 264 days 00:00:00

# Trades 2

Win Rate [%] 50.0

Best Trade [%] 26.999609

Worst Trade [%] -9.245114

Avg. Trade [%] 7.358442

Max. Trade Duration 486 days 00:00:00

Avg. Trade Duration 262 days 00:00:00

Profit Factor 2.920419

Expectancy [%] 8.877247

SQN 0.452121

_strategy RsiOscillator(up...

_equity_curve ...

_trades Size EntryB...

dtype: object

6. Multi-timeframe Strategies in Backtesting.py

https://www.youtube.com/watch?v=mEn1ZhYvluo&list=PLnSVMZC68_e48lA4aRYL1yHYZ9nEq9AiH&index=6&ab_channel=ChadThackray

resample_apply

다른 시간대에 인자를 함께 사용하는 것.

- long_momentum 과 short_momentum 활용

import talib

from backtesting import Backtest, Strategy

from backtesting.lib import crossover, resample_apply

from backtesting.test import GOOG

def momentum(arr, n=1): #n:number of bars you want to differencing

ind = (np.diff(arr, n=n)/arr[:-n]) * 100

ind = np.concatenate((np.zeros(n), ind))

return ind

class RsiOscillator(Strategy):

short_threshold = 0.1

long_threshold = 1

momentum_bars = 2

def init(self):

self.short_momentum = self.I(momentum, self.data.Close.s, self.momentum_bars)

self.long_momentum = resample_apply(

'W', momentum, self.data.Close.s, self.momentum_bars)#, plot=False)

def next(self):

if self.position:

if self.position.is_long:

if self.long_momentum[-1] < 0:

self.position.close()

elif self.position.is_short:

if self.long_momentum[-1] > 0:

self.position.close()

else:

if self.long_momentum[-1] > self.long_threshold and \

self.short_momentum > self.long_momentum:

self.buy()

elif self.short_momentum[-1] <self.short_threshold and\

self.long_momentum > self.short_momentum:

self.sell()

bt = Backtest(GOOG, RsiOscillator, cash=10_000_000, commission=.002)

stats = bt.run()

print(stats)

bt.plot()

Start 2004-08-19 00:00:00

End 2013-03-01 00:00:00

Duration 3116 days 00:00:00

Exposure Time [%] 70.996276

Equity Final [$] 5351487.51924

Equity Peak [$] 10452511.7372

Return [%] -46.485125

Buy & Hold Return [%] 703.458242

Return (Ann.) [%] -7.072329

Volatility (Ann.) [%] 22.254077

Sharpe Ratio 0.0

Sortino Ratio 0.0

Calmar Ratio 0.0

Max. Drawdown [%] -51.875419

Avg. Drawdown [%] -14.095066

Max. Drawdown Duration 3101 days 00:00:00

Avg. Drawdown Duration 778 days 00:00:00

# Trades 389

Win Rate [%] 41.388175

Best Trade [%] 16.833117

Worst Trade [%] -13.093012

Avg. Trade [%] -0.160594

Max. Trade Duration 29 days 00:00:00

Avg. Trade Duration 5 days 00:00:00

Profit Factor 0.901954

Expectancy [%] -0.109019

SQN -1.117336

_strategy RsiOscillator

_equity_curve ...

_trades Size Entr...

dtype: object

7. Walk Forward Optimization in Python with Backtesting.py

https://www.youtube.com/watch?v=9m987swadQU&list=PLnSVMZC68_e48lA4aRYL1yHYZ9nEq9AiH&index=7&ab_channel=ChadThackray

과적합하지 않기 위해 학습/검증세트를 나눠서 진행하는 과정을 보여줌.

import warnings

warnings.simplefilter(action='ignore', category=FutureWarning)

import os

import numpy as np

import pandas as pd

import pickle

from backtesting import Backtest, Strategy

from backtesting.lib import resample_apply

import matplotlib.pyplot as plt

from datetime import datetime

Loading data

# https://data.binance.vision/?prefix=data/spot/monthly/klines/AAVEBKRW/1m/

data = pd.read_csv('sample_data/AAVEBKRW-1m-2021-01.csv', usecols=[0,1,2,3,4])

data.columns = ['Date', 'Open', 'High', 'Low', 'Close']

data['Date'] = pd.to_datetime(data['Date'], unit='ms')

data.set_index('Date', inplace=True)

data

| Open | High | Low | Close | |

|---|---|---|---|---|

| Date | ||||

| 2021-01-01 00:01:00 | 98050.0 | 98050.0 | 98050.0 | 98050.0 |

| 2021-01-01 00:02:00 | 98050.0 | 98050.0 | 98050.0 | 98050.0 |

| 2021-01-01 00:03:00 | 98050.0 | 98050.0 | 98050.0 | 98050.0 |

| 2021-01-01 00:04:00 | 98050.0 | 98050.0 | 98050.0 | 98050.0 |

| 2021-01-01 00:05:00 | 98050.0 | 98050.0 | 98050.0 | 98050.0 |

| ... | ... | ... | ... | ... |

| 2021-01-14 11:55:00 | 153331.0 | 153331.0 | 153331.0 | 153331.0 |

| 2021-01-14 11:56:00 | 153331.0 | 153331.0 | 153331.0 | 153331.0 |

| 2021-01-14 11:57:00 | 153331.0 | 153331.0 | 153331.0 | 153331.0 |

| 2021-01-14 11:58:00 | 153331.0 | 153331.0 | 153331.0 | 153331.0 |

| 2021-01-14 11:59:00 | 164167.0 | 164167.0 | 164167.0 | 164167.0 |

19439 rows × 4 columns

Strategy Class

class MomentumStrategy(Strategy):

small_threshold = 0

large_threshold = 3 # 3%

def momentum(self, data):

return data.pct_change(periods=7).to_numpy() * 100

def init(self):

self.pct_change_long = resample_apply('2h', self.momentum, self.data.Close.s)

self.pct_change_short = resample_apply('30T', self.momentum, self.data.Close.s)

def next(self):

change_long = self.pct_change_long[-1]

change_short = self.pct_change_short[-1]

if self.position:

# check whether we should close

if self.position.is_long and change_short < self.small_threshold:

self.position.close()

elif self.position.is_short and change_short > -1*self.small_threshold:

self.position.close()

else:

# check whether we should go short/long

if change_long > self.large_threshold and change_short > self.small_threshold:

self.buy()

elif change_long < -1*self.large_threshold and change_short < -1*self.small_threshold:

self.sell()

Test Run

bt = Backtest(data[data.index < '2021-01-10'], MomentumStrategy, cash = 10_000_000, commission=0.002)

stats = bt.optimize(

small_threshold=list(np.arange(0, 1, 0.1)),

large_threshold=list(np.arange(1, 3, 0.2)),

maximize='Equity Final [$]',

max_tries=100

)

bt.plot()

display(stats['_strategy'])

display(stats)

display(stats['_trades'])

display(stats['_equity_curve'])

<Strategy MomentumStrategy(small_threshold=0.6000000000000001,large_threshold=2.3999999999999995)>

Start 2021-01-01 00:01:00

End 2021-01-09 23:59:00

Duration 8 days 23:58:00

Exposure Time [%] 38.606374

Equity Final [$] 8665618.576

Equity Peak [$] 11779736.016

Return [%] -13.343814

Buy & Hold Return [%] 37.311576

Return (Ann.) [%] -99.699789

Volatility (Ann.) [%] 1.019999

Sharpe Ratio 0.0

Sortino Ratio 0.0

Calmar Ratio 0.0

Max. Drawdown [%] -26.436224

Avg. Drawdown [%] -5.46489

Max. Drawdown Duration 5 days 17:16:00

Avg. Drawdown Duration 0 days 23:34:00

# Trades 25

Win Rate [%] 28.0

Best Trade [%] 12.074736

Worst Trade [%] -5.678155

Avg. Trade [%] -0.576904

Max. Trade Duration 0 days 11:00:00

Avg. Trade Duration 0 days 03:20:00

Profit Factor 0.651517

Expectancy [%] -0.515709

SQN -0.751871

_strategy MomentumStrategy...

_equity_curve ...

_trades Size EntryB...

dtype: object

| Size | EntryBar | ExitBar | EntryPrice | ExitPrice | PnL | ReturnPct | EntryTime | ExitTime | Duration | |

|---|---|---|---|---|---|---|---|---|---|---|

| 0 | 99 | 1440 | 1530 | 100337.274 | 96241.0 | -405531.126 | -0.040825 | 2021-01-02 00:01:00 | 2021-01-02 01:31:00 | 0 days 01:30:00 |

| 1 | -101 | 1920 | 2220 | 94724.172 | 93878.0 | 85463.372 | 0.008933 | 2021-01-02 08:01:00 | 2021-01-02 13:01:00 | 0 days 05:00:00 |

| 2 | 100 | 2880 | 3060 | 96232.080 | 96040.0 | -19208.000 | -0.001996 | 2021-01-03 00:01:00 | 2021-01-03 03:01:00 | 0 days 03:00:00 |

| 3 | 97 | 3720 | 4050 | 99292.188 | 101759.0 | 239280.764 | 0.024844 | 2021-01-03 14:01:00 | 2021-01-03 19:31:00 | 0 days 05:30:00 |

| 4 | 95 | 4110 | 4170 | 103756.098 | 102354.0 | -133199.310 | -0.013513 | 2021-01-03 20:31:00 | 2021-01-03 21:31:00 | 0 days 01:00:00 |

| 5 | 93 | 4230 | 4770 | 104502.588 | 117121.0 | 1173512.316 | 0.120747 | 2021-01-03 22:31:00 | 2021-01-04 07:31:00 | 0 days 09:00:00 |

| 6 | 96 | 5100 | 5430 | 113609.766 | 117121.0 | 337078.464 | 0.030906 | 2021-01-04 13:01:00 | 2021-01-04 18:31:00 | 0 days 05:30:00 |

| 7 | 90 | 5640 | 5730 | 124004.514 | 123757.0 | -22276.260 | -0.001996 | 2021-01-04 22:01:00 | 2021-01-04 23:31:00 | 0 days 01:30:00 |

| 8 | 86 | 5760 | 5970 | 129828.138 | 124030.0 | -498639.868 | -0.044660 | 2021-01-05 00:01:00 | 2021-01-05 03:31:00 | 0 days 03:30:00 |

| 9 | -94 | 6120 | 6210 | 113862.818 | 119186.0 | -500379.108 | -0.046751 | 2021-01-05 06:01:00 | 2021-01-05 07:31:00 | 0 days 01:30:00 |

| 10 | 82 | 6270 | 6630 | 124803.108 | 124030.0 | -63394.856 | -0.006195 | 2021-01-05 08:31:00 | 2021-01-05 14:31:00 | 0 days 06:00:00 |

| 11 | 78 | 6840 | 6870 | 129578.640 | 129320.0 | -20173.920 | -0.001996 | 2021-01-05 18:01:00 | 2021-01-05 18:31:00 | 0 days 00:30:00 |

| 12 | 76 | 6930 | 6990 | 133717.902 | 133713.0 | -372.552 | -0.000037 | 2021-01-05 19:31:00 | 2021-01-05 20:31:00 | 0 days 01:00:00 |

| 13 | 75 | 7080 | 7140 | 134376.216 | 134108.0 | -20116.200 | -0.001996 | 2021-01-05 22:01:00 | 2021-01-05 23:01:00 | 0 days 01:00:00 |

| 14 | -81 | 7320 | 7530 | 124201.100 | 126932.0 | -221202.900 | -0.021988 | 2021-01-06 02:01:00 | 2021-01-06 05:31:00 | 0 days 03:30:00 |

| 15 | 75 | 8160 | 8250 | 130689.858 | 130429.0 | -19564.350 | -0.001996 | 2021-01-06 16:01:00 | 2021-01-06 17:31:00 | 0 days 01:30:00 |

| 16 | 73 | 9240 | 9360 | 135364.188 | 132790.0 | -187915.724 | -0.019017 | 2021-01-07 10:01:00 | 2021-01-07 12:01:00 | 0 days 02:00:00 |

| 17 | 68 | 9480 | 9690 | 141136.710 | 135877.0 | -357660.280 | -0.037267 | 2021-01-07 14:01:00 | 2021-01-07 17:31:00 | 0 days 03:30:00 |

| 18 | 69 | 9990 | 10050 | 135364.188 | 127678.0 | -530346.972 | -0.056782 | 2021-01-07 22:31:00 | 2021-01-07 23:31:00 | 0 days 01:00:00 |

| 19 | -68 | 10080 | 10410 | 129271.938 | 124269.0 | 340199.784 | 0.038701 | 2021-01-08 00:01:00 | 2021-01-08 05:31:00 | 0 days 05:30:00 |

| 20 | -70 | 10800 | 11460 | 130993.488 | 128943.0 | 143534.160 | 0.015653 | 2021-01-08 12:01:00 | 2021-01-08 23:01:00 | 0 days 11:00:00 |

| 21 | -75 | 11670 | 11730 | 123831.840 | 129569.0 | -430287.000 | -0.046330 | 2021-01-09 02:31:00 | 2021-01-09 03:31:00 | 0 days 01:00:00 |

| 22 | 67 | 12240 | 12420 | 130729.938 | 130894.0 | 10992.154 | 0.001255 | 2021-01-09 12:01:00 | 2021-01-09 15:01:00 | 0 days 03:00:00 |

| 23 | 66 | 12480 | 12630 | 133782.030 | 130942.0 | -187441.980 | -0.021229 | 2021-01-09 16:01:00 | 2021-01-09 18:31:00 | 0 days 02:30:00 |

| 24 | 64 | 12780 | 12958 | 135364.188 | 134634.0 | -46732.032 | -0.005394 | 2021-01-09 21:01:00 | 2021-01-09 23:59:00 | 0 days 02:58:00 |

| Equity | DrawdownPct | DrawdownDuration | |

|---|---|---|---|

| Date | |||

| 2021-01-01 00:01:00 | 1.000000e+07 | 0.000000 | NaT |

| 2021-01-01 00:02:00 | 1.000000e+07 | 0.000000 | NaT |

| 2021-01-01 00:03:00 | 1.000000e+07 | 0.000000 | NaT |

| 2021-01-01 00:04:00 | 1.000000e+07 | 0.000000 | NaT |

| 2021-01-01 00:05:00 | 1.000000e+07 | 0.000000 | NaT |

| ... | ... | ... | ... |

| 2021-01-09 23:55:00 | 8.665619e+06 | 0.264362 | NaT |

| 2021-01-09 23:56:00 | 8.665619e+06 | 0.264362 | NaT |

| 2021-01-09 23:57:00 | 8.665619e+06 | 0.264362 | NaT |

| 2021-01-09 23:58:00 | 8.665619e+06 | 0.264362 | NaT |

| 2021-01-09 23:59:00 | 8.665619e+06 | 0.264362 | 5 days 17:16:00 |

12959 rows × 3 columns

Walk Forward

하이퍼파라미터를 찾아 계속 주기적으로 변경해주었을 때, 결과를 볼수 있음

def walk_forward(

strategy,

data_full,

warmup_bars, # 롤링을 위한 기간(?)

lookback_bars,

validation_bars,

cash = 10_000_000,

commission = .002

):

stats_master = []

for i in range(lookback_bars+warmup_bars, len(data_full) - validation_bars, validation_bars):

training_data = data_full.iloc[i-lookback_bars-warmup_bars:i]

validation_data = data_full.iloc[i-warmup_bars:i+validation_bars]

print(training_data)

print(validation_data)

bt_training = Backtest(training_data, strategy, cash=cash, commission=commission)

stats_training = bt.optimize(

small_threshold=list(np.arange(0, 1, 0.1)),

large_threshold=list(np.arange(1, 3, 0.2)),

maximize='Equity Final [$]',

max_tries=50

)

small_threshold = stats_training._strategy.small_threshold

large_threshold = stats_training._strategy.large_threshold

bt_validation = Backtest(validation_data, strategy, cash=cash, commission=commission)

stats_validation = bt_validation.run(

small_threshold=small_threshold,

large_threshold = large_threshold)

stats_master.append(stats_validation)

#break

return stats_master

Run Walk-forward

lookback_bars = 4*24*60

validation_bars = 1*24*60

warmup_bars = (7+1)*2*60 # 7period, 30분으로 리샘플, 동영상 32분 설명

stats = walk_forward(MomentumStrategy,

data,

lookback_bars=lookback_bars,

validation_bars = validation_bars,

warmup_bars = warmup_bars)

Open High Low Close

Date

2021-01-01 00:01:00 98050.0 98050.0 98050.0 98050.0

2021-01-01 00:02:00 98050.0 98050.0 98050.0 98050.0

2021-01-01 00:03:00 98050.0 98050.0 98050.0 98050.0

2021-01-01 00:04:00 98050.0 98050.0 98050.0 98050.0

2021-01-01 00:05:00 98050.0 98050.0 98050.0 98050.0

... ... ... ... ...

2021-01-05 15:56:00 129569.0 129569.0 129569.0 129569.0

2021-01-05 15:57:00 129569.0 129569.0 129569.0 129569.0

2021-01-05 15:58:00 129569.0 129569.0 129569.0 129569.0

2021-01-05 15:59:00 129569.0 129569.0 129569.0 129569.0

2021-01-05 16:00:00 129569.0 129569.0 129569.0 129569.0

[6720 rows x 4 columns]

Open High Low Close

Date

2021-01-05 00:01:00 129569.0 129569.0 129569.0 129569.0

2021-01-05 00:02:00 129569.0 129569.0 129569.0 129569.0

2021-01-05 00:03:00 129569.0 129569.0 129569.0 129569.0

2021-01-05 00:04:00 129569.0 129569.0 129569.0 129569.0

2021-01-05 00:05:00 129569.0 129569.0 129569.0 129569.0

... ... ... ... ...

2021-01-06 15:56:00 130429.0 130429.0 130429.0 130429.0

2021-01-06 15:57:00 130429.0 130429.0 130429.0 130429.0

2021-01-06 15:58:00 130429.0 130429.0 130429.0 130429.0

2021-01-06 15:59:00 130429.0 130429.0 130429.0 130429.0

2021-01-06 16:00:00 130429.0 130429.0 130429.0 130429.0

[2400 rows x 4 columns]

len(stats)

8

lookback_bars+warmup_bars, len(data) - validation_bars, validation_bars

(6720, 17999, 1440)

stats[0]._strategy

<Strategy MomentumStrategy(small_threshold=0.6000000000000001,large_threshold=2.3999999999999995)>

strategy_returns = [x['Return [%]'] for x in stats]

hold_returns = [x['Buy & Hold Return [%]'] for x in stats]

import statistics

print('hold return mean :', statistics.mean(hold_returns))

print('strategy return mean :', statistics.mean(strategy_returns))

hold return mean : 1.2828625333049686

strategy return mean : -1.4043760225000046

Plots

Plot stats of particular result

def plot_stats(data_full, stats):

equity_curve = stats._equity_curve

aligned_data = data.reindex(equity_curve.index)

bt=Backtest(aligned_data, MomentumStrategy, cash=10_000_000, commission=0.002)

bt.plot(results=stats)

plot_stats(data, stats[0])

Plot full equity curve of all validation tests

def plot_full_equity_curve(

data,

stats_list,

warmup_bars,

lookback_bars):

equity_curves = [x['_equity_curve'].iloc[warmup_bars:] for x in stats_list]

combined = pd.concat(equity_curves)

# for curve in equity_curves:

# if len(combined) == 0:

# combined = curve['Equity']/1e7

# else:

# combined = pd.concat([combined, (curve['Equity']/1e7)*combined.iloc[-1]])

alinged_price_data = data[data.index <= combined.index[-1]].iloc[lookback_bars + warmup_bars:]

plt.style.use('fivethirtyeight')

fig, ax1 = plt.subplots()

ax1.plot(combined.index, combined.Equity, label='equity')

ax1.legend(loc='upper left')

ax2 = ax1.twinx()

ax2.plot(alinged_price_data.index, alinged_price_data.Close, color='orange', label='price')

ax2.legend(loc='upper right')

plt.show()

print(combined)

plot_full_equity_curve(data, stats, warmup_bars, lookback_bars)

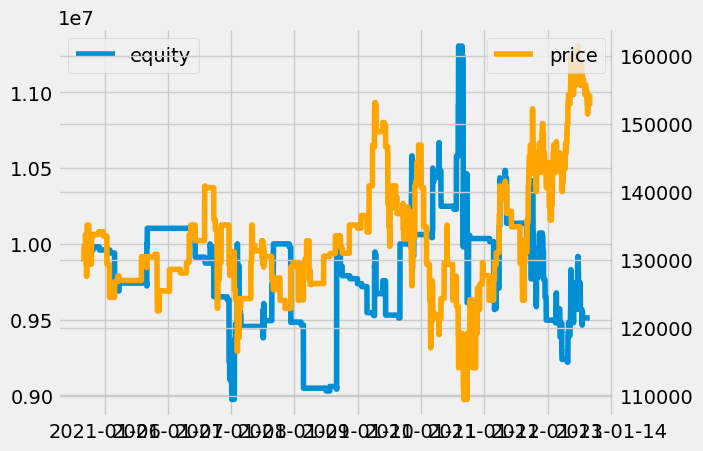

검증세트로 투자한 것을 연결해서 표현한 그림

Equity DrawdownPct DrawdownDuration

2021-01-05 16:01:00 1.000000e+07 0.00000 NaT

2021-01-05 16:02:00 1.000000e+07 0.00000 NaT

2021-01-05 16:03:00 1.000000e+07 0.00000 NaT

2021-01-05 16:04:00 1.000000e+07 0.00000 NaT

2021-01-05 16:05:00 1.000000e+07 0.00000 NaT

... ... ... ...

2021-01-13 15:56:00 9.511412e+06 0.08688 NaT

2021-01-13 15:57:00 9.511412e+06 0.08688 NaT

2021-01-13 15:58:00 9.511412e+06 0.08688 NaT

2021-01-13 15:59:00 9.511412e+06 0.08688 NaT

2021-01-13 16:00:00 9.511412e+06 0.08688 0 days 21:41:00

[11520 rows x 3 columns]

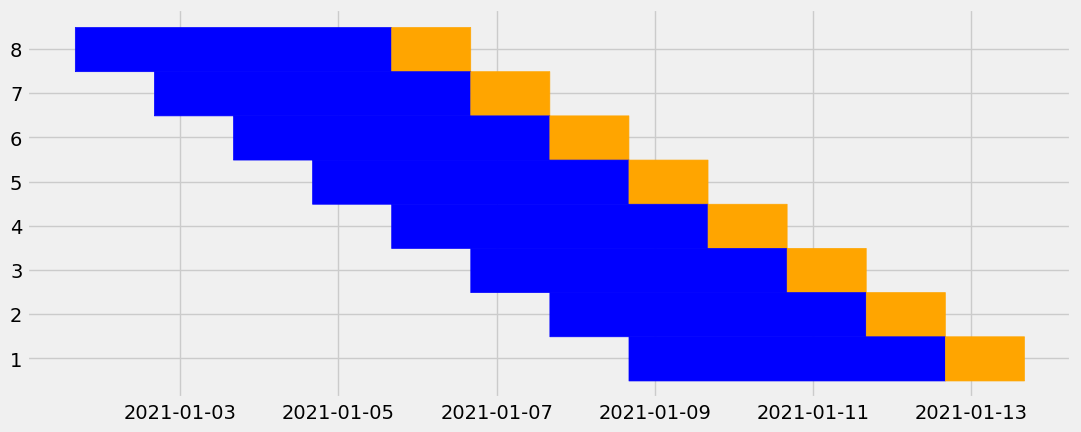

Plot Flow graph of training vs test data

def plot_flow_graph(

data_full,

lookback_bars,

validation_bars):

ranges = list(range(lookback_bars+warmup_bars, len(data_full) - validation_bars, validation_bars))

fig, ax = plt.subplots()

fig.set_figwidth(12)

for i in range(len(ranges)):

# 위의 i -> ranges[i]

# warmup_bars 삭제

training_data = data_full.iloc[ranges[i]-lookback_bars:ranges[i]]

validation_data = data_full.iloc[ranges[i]:ranges[i]+validation_bars]

plt.fill_between(training_data.index,

[len(ranges)-i-0.5] * len(training_data.index),

[len(ranges)-i+0.5] * len(training_data.index),

color='blue')

plt.fill_between(validation_data.index,

[len(ranges)-i-0.5] * len(validation_data.index),

[len(ranges)-i+0.5] * len(validation_data.index),

color='orange')

plt.show()

plot_flow_graph(data, lookback_bars, validation_bars)

학습/검증 세트의 구성을 보여주는 그림

8. Fractional Shares in Backtesting.py

https://www.youtube.com/watch?v=3yu4FWmTNh0&list=PLnSVMZC68_e48lA4aRYL1yHYZ9nEq9AiH&index=8&ab_channel=ChadThackray

import datetime

import pandas_ta as ta

from backtesting import Backtest, Strategy

from backtesting.lib import crossover

from backtesting.test import GOOG

print(GOOG)

factor = 1000

GOOG.Open /= factor

GOOG.High /= factor

GOOG.Low /= factor

GOOG.Close /= factor

GOOG.Volume *= factor

print(GOOG)

class RsiOscillator(Strategy):

upper_bound=70

lower_bound=30

rsi_window=14

def init(self):

self.rsi = self.I(ta.rsi, self.data.Close.s, self.rsi_window)

def next(self):

if crossover(self.rsi, self.upper_bound):

self.position.close()

elif crossover(self.lower_bound, self.rsi):

if not self.position:

self.buy()

bt = Backtest(GOOG, RsiOscillator, cash=10_000_000, commission=0.002)

stats = bt.run()

display(stats)

bt.plot()

Open High Low Close Volume Signal

2004-08-19 100.00 104.06 95.96 100.34 22351900 1

2004-08-20 101.01 109.08 100.50 108.31 11428600 -1

2004-08-23 110.75 113.48 109.05 109.40 9137200 -1

2004-08-24 111.24 111.60 103.57 104.87 7631300 -1

2004-08-25 104.96 108.00 103.88 106.00 4598900 1

... ... ... ... ... ... ...

2013-02-25 802.30 808.41 790.49 790.77 2303900 1

2013-02-26 795.00 795.95 784.40 790.13 2202500 1

2013-02-27 794.80 804.75 791.11 799.78 2026100 -1

2013-02-28 801.10 806.99 801.03 801.20 2265800 -1

2013-03-01 797.80 807.14 796.15 806.19 2175400 0

[2148 rows x 6 columns]

Open High Low Close Volume Signal

2004-08-19 0.10000 0.10406 0.09596 0.10034 22351900000 1

2004-08-20 0.10101 0.10908 0.10050 0.10831 11428600000 -1

2004-08-23 0.11075 0.11348 0.10905 0.10940 9137200000 -1

2004-08-24 0.11124 0.11160 0.10357 0.10487 7631300000 -1

2004-08-25 0.10496 0.10800 0.10388 0.10600 4598900000 1

... ... ... ... ... ... ...

2013-02-25 0.80230 0.80841 0.79049 0.79077 2303900000 1

2013-02-26 0.79500 0.79595 0.78440 0.79013 2202500000 1

2013-02-27 0.79480 0.80475 0.79111 0.79978 2026100000 -1

2013-02-28 0.80110 0.80699 0.80103 0.80120 2265800000 -1

2013-03-01 0.79780 0.80714 0.79615 0.80619 2175400000 0

[2148 rows x 6 columns]

Start 2004-08-19 00:00:00

End 2013-03-01 00:00:00

Duration 3116 days 00:00:00

Exposure Time [%] 29.329609

Equity Final [$] 15534282.599116

Equity Peak [$] 15694342.224296

Return [%] 55.342826

Buy & Hold Return [%] 703.458242

Return (Ann.) [%] 5.303301

Volatility (Ann.) [%] 23.920019

Sharpe Ratio 0.22171

Sortino Ratio 0.371751

Calmar Ratio 0.107059

Max. Drawdown [%] -49.53641

Avg. Drawdown [%] -6.240949

Max. Drawdown Duration 1603 days 00:00:00

Avg. Drawdown Duration 94 days 00:00:00

# Trades 9

Win Rate [%] 77.777778

Best Trade [%] 21.155672

Worst Trade [%] -20.607876

Avg. Trade [%] 5.015784

Max. Trade Duration 202 days 00:00:00

Avg. Trade Duration 101 days 00:00:00

Profit Factor 3.418112

Expectancy [%] 5.723001

SQN 1.184484

_strategy RsiOscillator

_equity_curve ...

_trades Size Ent...

dtype: object

stats._trades

| Size | EntryBar | ExitBar | EntryPrice | ExitPrice | PnL | ReturnPct | EntryTime | ExitTime | Duration | |

|---|---|---|---|---|---|---|---|---|---|---|

| 0 | 27572979 | 373 | 422 | 0.362674 | 0.43940 | 2.115567e+06 | 0.211557 | 2006-02-10 | 2006-04-24 | 73 days |

| 1 | 33128895 | 493 | 525 | 0.365710 | 0.41546 | 1.648164e+06 | 0.136037 | 2006-08-03 | 2006-09-19 | 47 days |

| 2 | 24497973 | 862 | 925 | 0.561831 | 0.55794 | -9.533190e+04 | -0.006926 | 2008-01-23 | 2008-04-23 | 91 days |

| 3 | 29227624 | 987 | 1126 | 0.467653 | 0.37128 | -2.816767e+06 | -0.206079 | 2008-07-22 | 2009-02-09 | 202 days |

| 4 | 19813704 | 1367 | 1424 | 0.547683 | 0.56300 | 3.034829e+05 | 0.027967 | 2010-01-25 | 2010-04-16 | 81 days |

| 5 | 22222143 | 1437 | 1534 | 0.501982 | 0.51286 | 2.417334e+05 | 0.021670 | 2010-05-05 | 2010-09-22 | 140 days |

| 6 | 19857019 | 1653 | 1740 | 0.573946 | 0.59249 | 3.682365e+05 | 0.032310 | 2011-03-14 | 2011-07-18 | 126 days |

| 7 | 20527994 | 1873 | 1913 | 0.573124 | 0.64660 | 1.508316e+06 | 0.128203 | 2012-01-26 | 2012-03-23 | 57 days |

| 8 | 20235098 | 2072 | 2129 | 0.655959 | 0.76769 | 2.260882e+06 | 0.170332 | 2012-11-09 | 2013-02-04 | 87 days |

9. Multi-threaded Backtesting in python

멀티스레드를 사용하는 경우 이 예에서는 3배의 속도 차이 발생

#### .py 파일로 실행해야함

# from datetime import datetime

# import pandas_ta as ta

# import pandas as pd

# import os

# import time

# from backtesting import Backtest, Strategy

# from backtesting.lib import crossover

# from multiprocessing import Pool

# class RsiOscillator(Strategy):

# upper_bound=70

# lower_bound=30

# rsi_window=14

# def init(self):

# self.rsi = self.I(ta.rsi, self.data.Close.s, self.rsi_window)

# def next(self):

# if crossover(self.rsi, self.upper_bound):

# self.position.close()

# elif crossover(self.lower_bound, self.rsi):

# if not self.position:

# self.buy()

# def do_backtest(ticker = 'KODEX 200'):

# start_date = datetime(2018, 1, 1)

# df = pd.read_pickle("../crawling/data/etf_price.pickle")

# df.columns = ['NAV','Open','High','Low','Close','Volume','Amount','base','ticker','code','Date']

# df['Date'] = pd.to_datetime(df['Date'])

# cond = (df['ticker']==ticker) & (df['Date']>start_date)

# data = df[cond].reset_index(drop=True)

# data = data[['Date','Open','High','Low','Close','Volume']].set_index('Date')

# for col in data.columns:

# data[col] = pd.to_numeric(data[col]).astype('float')

# bt = Backtest(data, RsiOscillator, cash=10_000_000, commission=0.002)

# stats = bt.run()

# return (ticker, stats['Return [%]'])

# if __name__ == '__main__':

# tickers = ['KODEX 200선물인버스2X', 'KODEX 미국반도체MV','KODEX 코스피','TIGER 2차전지테마',

# 'KODEX 미국반도체MV', 'TIGER 200 IT', 'TIGER Fn신재생에너지','TIGER 코스닥150선물인버스',

# 'KBSTAR 미국S&P원유생산기업(합성 H)']

# start_time = time.time()

# with Pool() as p: #after pool is done, this will clean up memory

# results = p.map(do_backtest, tickers)

# time_taken = time.time() - start_time

# print(f"Took {time_taken} seconds")

# print(results)

from datetime import datetime

import pandas_ta as ta

import pandas as pd

import os

import time

class RsiOscillator(Strategy):

upper_bound=70

lower_bound=30

rsi_window=14

def init(self):

self.rsi = self.I(ta.rsi, self.data.Close.s, self.rsi_window)

def next(self):

if crossover(self.rsi, self.upper_bound):

self.position.close()

elif crossover(self.lower_bound, self.rsi):

if not self.position:

self.buy()

def do_backtest(ticker = 'KODEX 200'):

start_date = datetime(2018, 1, 1)

df = pd.read_pickle("../crawling/data/etf_price.pickle")

df.columns = ['NAV','Open','High','Low','Close','Volume','Amount','base','ticker','code','Date']

df['Date'] = pd.to_datetime(df['Date'])

cond = (df['ticker']==ticker) & (df['Date']>start_date)

data = df[cond].reset_index(drop=True)

data = data[['Date','Open','High','Low','Close','Volume']].set_index('Date')

for col in data.columns:

data[col] = pd.to_numeric(data[col]).astype('float')

bt = Backtest(data, RsiOscillator, cash=10_000_000, commission=0.002)

stats = bt.run()

return (ticker, stats['Return [%]'])

def do_backtest(ticker = 'KODEX 200'):

start_date = datetime(2018, 1, 1)

df = pd.read_pickle("../crawling/data/etf_price.pickle")

df.columns = ['NAV','Open','High','Low','Close','Volume','Amount','base','ticker','code','Date']

df['Date'] = pd.to_datetime(df['Date'])

cond = (df['ticker']==ticker) & (df['Date']>start_date)

data = df[cond].reset_index(drop=True)

data = data[['Date','Open','High','Low','Close','Volume']].set_index('Date')

for col in data.columns:

data[col] = pd.to_numeric(data[col]).astype('float')

bt = Backtest(data, RsiOscillator, cash=10_000_000, commission=0.002)

stats = bt.run()

return (ticker, stats['Return [%]'])

tickers = ['KODEX 200선물인버스2X', 'KODEX 미국반도체MV','KODEX 코스피','TIGER 2차전지테마',

'KODEX 미국반도체MV', 'TIGER 200 IT', 'TIGER Fn신재생에너지','TIGER 코스닥150선물인버스',

'KBSTAR 미국S&P원유생산기업(합성 H)']

tickers = tickers*10

start_time = time.time()

for ticker in tickers:

print(do_backtest(ticker))

time_taken = time.time() - start_time

print(f"Took {time_taken} seconds")

('KODEX 200선물인버스2X', -58.9937544)

('KODEX 미국반도체MV', 18.611619400000013)

('KODEX 코스피', -26.63166719999997)

('TIGER 2차전지테마', 126.3208749)

('KODEX 미국반도체MV', 18.611619400000013)

('TIGER 200 IT', 13.659680999999976)

('TIGER Fn신재생에너지', 9.86832450000001)

('TIGER 코스닥150선물인버스', 34.32884810000002)

('KBSTAR 미국S&P원유생산기업(합성 H)', -20.03688280000001)

('KODEX 200선물인버스2X', -58.9937544)

('KODEX 미국반도체MV', 18.611619400000013)

('KODEX 코스피', -26.63166719999997)

('TIGER 2차전지테마', 126.3208749)

('KODEX 미국반도체MV', 18.611619400000013)

('TIGER 200 IT', 13.659680999999976)

('TIGER Fn신재생에너지', 9.86832450000001)

('TIGER 코스닥150선물인버스', 34.32884810000002)

('KBSTAR 미국S&P원유생산기업(합성 H)', -20.03688280000001)

('KODEX 200선물인버스2X', -58.9937544)

('KODEX 미국반도체MV', 18.611619400000013)

('KODEX 코스피', -26.63166719999997)

('TIGER 2차전지테마', 126.3208749)

('KODEX 미국반도체MV', 18.611619400000013)

('TIGER 200 IT', 13.659680999999976)

('TIGER Fn신재생에너지', 9.86832450000001)

('TIGER 코스닥150선물인버스', 34.32884810000002)

('KBSTAR 미국S&P원유생산기업(합성 H)', -20.03688280000001)

('KODEX 200선물인버스2X', -58.9937544)

('KODEX 미국반도체MV', 18.611619400000013)

('KODEX 코스피', -26.63166719999997)

('TIGER 2차전지테마', 126.3208749)

('KODEX 미국반도체MV', 18.611619400000013)

('TIGER 200 IT', 13.659680999999976)

('TIGER Fn신재생에너지', 9.86832450000001)

('TIGER 코스닥150선물인버스', 34.32884810000002)

('KBSTAR 미국S&P원유생산기업(합성 H)', -20.03688280000001)

('KODEX 200선물인버스2X', -58.9937544)

('KODEX 미국반도체MV', 18.611619400000013)

('KODEX 코스피', -26.63166719999997)

('TIGER 2차전지테마', 126.3208749)

('KODEX 미국반도체MV', 18.611619400000013)

('TIGER 200 IT', 13.659680999999976)

('TIGER Fn신재생에너지', 9.86832450000001)

('TIGER 코스닥150선물인버스', 34.32884810000002)

('KBSTAR 미국S&P원유생산기업(합성 H)', -20.03688280000001)

('KODEX 200선물인버스2X', -58.9937544)

('KODEX 미국반도체MV', 18.611619400000013)

('KODEX 코스피', -26.63166719999997)

('TIGER 2차전지테마', 126.3208749)

('KODEX 미국반도체MV', 18.611619400000013)

('TIGER 200 IT', 13.659680999999976)

('TIGER Fn신재생에너지', 9.86832450000001)

('TIGER 코스닥150선물인버스', 34.32884810000002)

('KBSTAR 미국S&P원유생산기업(합성 H)', -20.03688280000001)

('KODEX 200선물인버스2X', -58.9937544)

('KODEX 미국반도체MV', 18.611619400000013)

('KODEX 코스피', -26.63166719999997)

('TIGER 2차전지테마', 126.3208749)

('KODEX 미국반도체MV', 18.611619400000013)

('TIGER 200 IT', 13.659680999999976)

('TIGER Fn신재생에너지', 9.86832450000001)

('TIGER 코스닥150선물인버스', 34.32884810000002)

('KBSTAR 미국S&P원유생산기업(합성 H)', -20.03688280000001)

('KODEX 200선물인버스2X', -58.9937544)

('KODEX 미국반도체MV', 18.611619400000013)

('KODEX 코스피', -26.63166719999997)

('TIGER 2차전지테마', 126.3208749)

('KODEX 미국반도체MV', 18.611619400000013)

('TIGER 200 IT', 13.659680999999976)

('TIGER Fn신재생에너지', 9.86832450000001)

('TIGER 코스닥150선물인버스', 34.32884810000002)

('KBSTAR 미국S&P원유생산기업(합성 H)', -20.03688280000001)

('KODEX 200선물인버스2X', -58.9937544)

('KODEX 미국반도체MV', 18.611619400000013)

('KODEX 코스피', -26.63166719999997)

('TIGER 2차전지테마', 126.3208749)

('KODEX 미국반도체MV', 18.611619400000013)

('TIGER 200 IT', 13.659680999999976)

('TIGER Fn신재생에너지', 9.86832450000001)

('TIGER 코스닥150선물인버스', 34.32884810000002)

('KBSTAR 미국S&P원유생산기업(합성 H)', -20.03688280000001)

('KODEX 200선물인버스2X', -58.9937544)

('KODEX 미국반도체MV', 18.611619400000013)

('KODEX 코스피', -26.63166719999997)

('TIGER 2차전지테마', 126.3208749)

('KODEX 미국반도체MV', 18.611619400000013)

('TIGER 200 IT', 13.659680999999976)

('TIGER Fn신재생에너지', 9.86832450000001)

('TIGER 코스닥150선물인버스', 34.32884810000002)

('KBSTAR 미국S&P원유생산기업(합성 H)', -20.03688280000001)

Took 19.13048505783081 seconds

댓글남기기